Since the first publication of the S&P Indices Versus Active (SPIVA®) U.S. Scorecard in 2002, S&P Dow Jones Indices has regularly reported on the relative performance of actively managed funds versus benchmark indices across an increasing number of global fund markets and fund categories.1

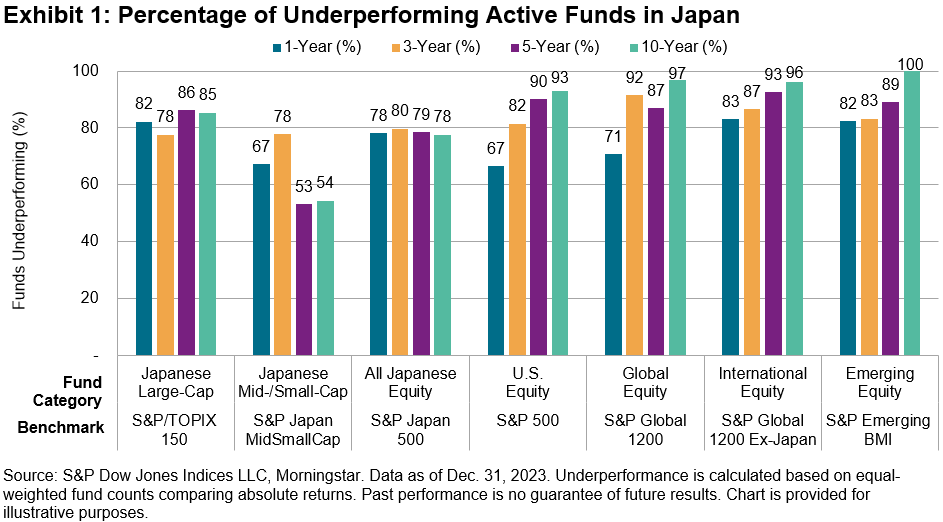

The SPIVA Japan Scorecard has been tracking the performance of active funds offered in Japan since 2014, covering large-, mid- and small-cap segments, as well as international and global equity funds. Over these years, we found that a significant majority of active funds in Japan underperformed their assigned benchmark in each of our reported fund categories. Exhibit 1 summarizes the underperformance rate of active funds in Japan over the 1-, 3-, 5- and 10-year periods ending on Dec. 31, 2023, across different fund categories.

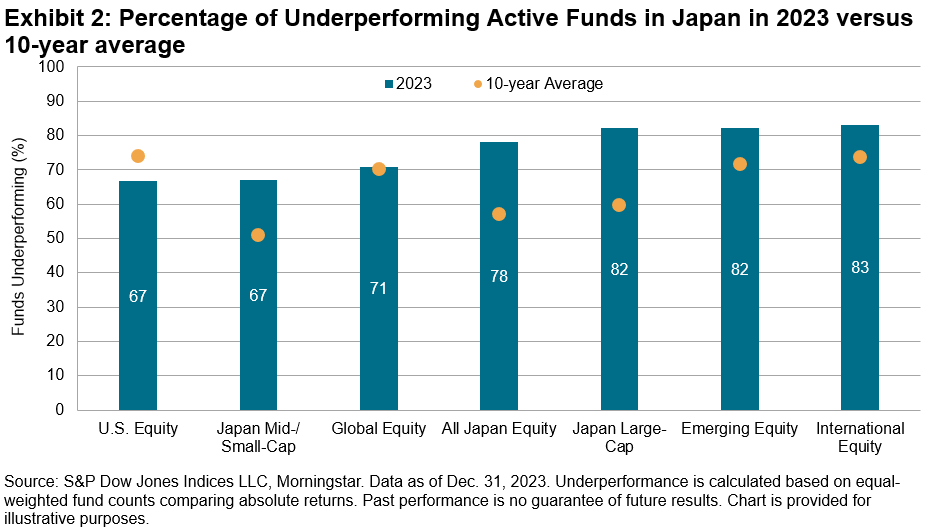

While 2023 marked an epic turnaround for Japanese equities with a reprieve from long-suffering deflation, it was a challenging year for Japanese active managers. 78% of Japanese domestic equity funds (All Japan Equity category) underperformed the broad-based S&P Japan 500 over the full year 2023. Furthermore, over two-thirds of equity funds underperformed their benchmarks in every reported category, posting underperformance rates worse than their 10-year averages in nearly all categories except for the U.S. Equity (see Exhibit 2).

What could explain last year’s misfortune of Japanese active fund managers? Among many possible explanations, we found three market conditions that posed challenges for active managers.

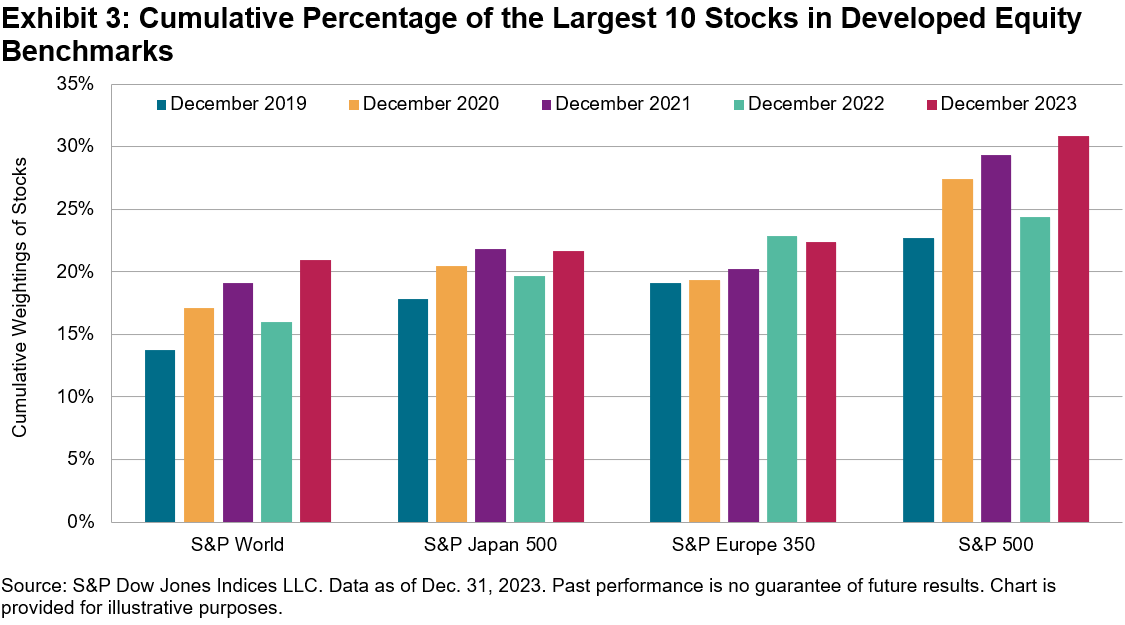

- Large-cap outperformance: The outperformance of large-cap companies was one of the key market trends in 2023. This was well publicized in the U.S. market with the so-called “Magnificent Seven,” namely Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla, which contributed 58% of the S&P 500®’s return in 2023. Similarly in Japan, the large-cap S&P/TOPIX 150 outperformed the S&P Japan MidSmallCap by 4% in 2023, resulting in increased market concentration (see Exhibit 3). This environment would have worked against active managers who searched for a source of outperformance among smaller, lesser-known names.

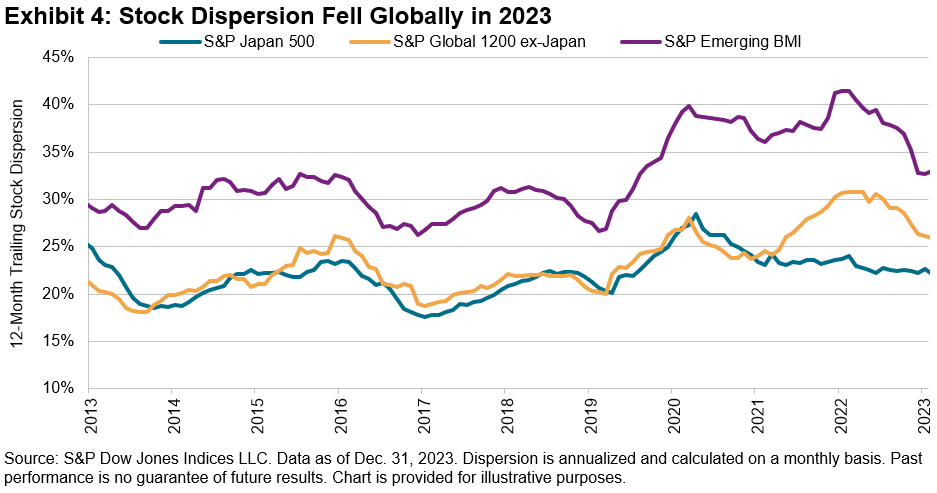

- Falling dispersion: Dispersion,2 the degree to which stocks differ from the average performance, measures the opportunity set for active managers to outperform through stock selection. Dispersion moved lower globally in 2023, though it remained elevated relative to its history (see Exhibit 4), which points to reduced opportunities for active managers overall.

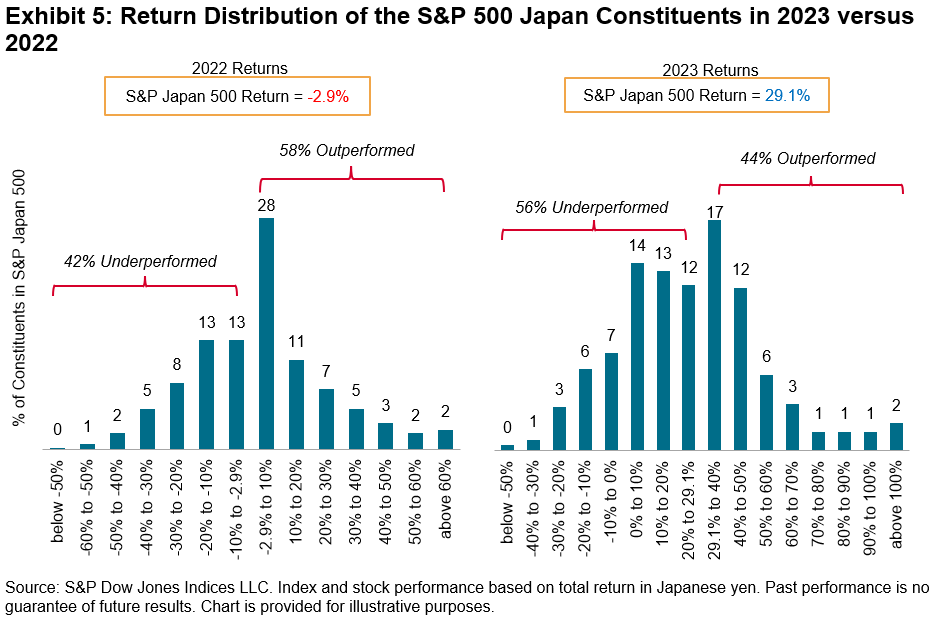

- Return distribution: Stating the obvious, when fewer stocks outperform the benchmark, it becomes less likely for managers to find them. In 2023, the percentage of constituents outperforming their benchmark fell well below 50% across domestic and global benchmarks amid a strong market rally. In Japan, the percentage of constituents outperforming the S&P 500 Japan dropped from 58% in 2022 to 44% in 2023 (see Exhibit 5).

To learn more, we invite you to explore the results of our SPIVA Japan Year-End 2023.

1 See SPIVA Around the World and SPIVA Fixed Income Around the World for the latest results of equity and fixed income funds across all covered markets.

2 See Tim Edwards and Craig J. Lazzara, “Dispersion: Measuring Market Opportunity,” S&P Dow Jones Indices LLC, 2014

The posts on this blog are opinions, not advice. Please read our Disclaimers.