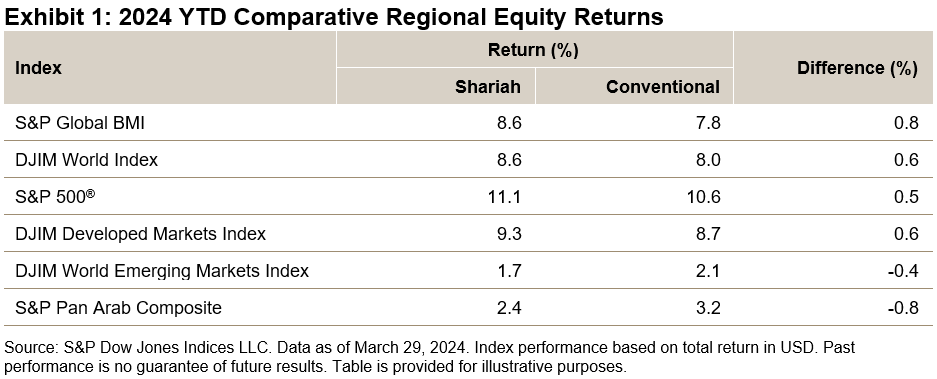

Global equities had a strong start to the year as economic resilience and diminishing recession fears boosted risky assets overall. The S&P Global BMI surged 7.8% in the first quarter, led by developed markets; notably, the S&P 500® finished the quarter up 10.6%, at a new record high. Shariah-compliant global benchmarks beat their conventional counterparts, with the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index generating an outperformance of 0.8% and 0.6%, respectively, during the quarter. The DJIM World Emerging Markets Index was a laggard, trailing behind the conventional benchmark as well as the developed market counterpart (see Exhibit 1).

MENA equities lagged along with emerging markets, with the S&P Pan Arab Composite posting a modest gain of 3.2%. Egypt was among the worst performers, with the S&P Egypt BMI falling 27.4% in U.S. dollar terms. The Egyptian pound shed over one-third of its value against the U.S. dollar during the quarter, as the country agreed on a USD 8 billion support program with the International Monetary Fund and let go of control on its currency in a bid for economic stability. GCC countries largely posted gains led by Kuwait (8.1%) and Bahrain (8.0%), while Qatar was an exception, with a 3.3% loss.

Drivers of Shariah Index Performance in Q1 2024

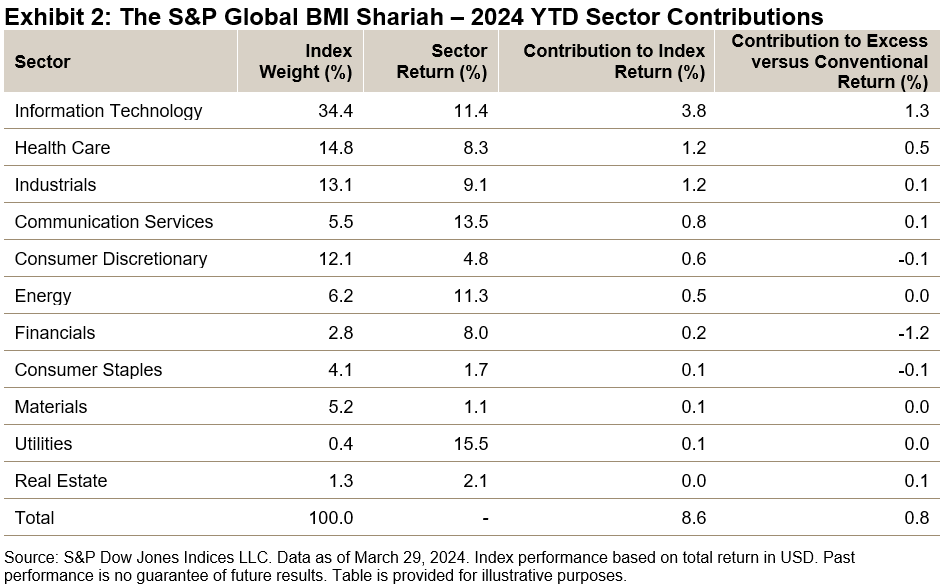

All sectors contributed positively to the S&P Global BMI Shariah in the first quarter. Extending the trend in 2023, Information Technology continued to be the largest contributor, accounting for 44% of the index return and generating an excess return of 1.3% versus the conventional benchmark. On the other hand, Financials contributed most negatively to the relative performance, with an excess return of -1.2%, due to its lower weightings as compared to the conventional benchmark (see Exhibit 2).

Global Sukuk Fared Better than Bonds in Q1 2024

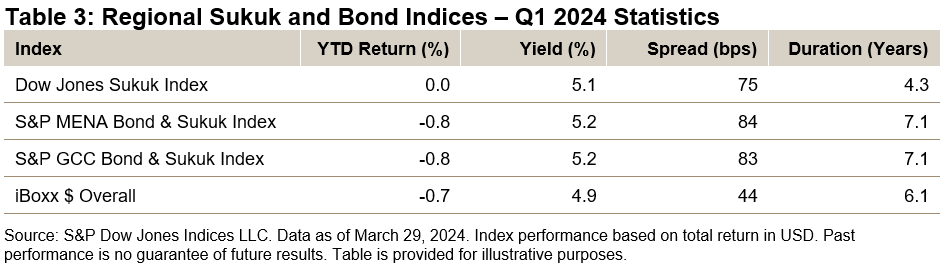

The Sukuk market was largely muted, with a close-to-zero gain in the first quarter as measured by the Dow Jones Sukuk Index. The benchmark outperformed the regional MENA and GCC Bond & Sukuk benchmarks as well as the global iBoxx USD Overall, as shorter-dated securities generally outperformed longer-dated ones during the quarter.

This article was first published in IFN Volume 21 Issue 16 dated April 17, 2024.

The posts on this blog are opinions, not advice. Please read our Disclaimers.